Whose game is it anyway? Perth Rental Market Report June 2019

/If you are interested in renting or even buying in WA, check out our review of the current rental market, circa June 2019! If you want to live in Perth long term, invest, or even just dip your toe in to see if Perth is for you – this report will help you get a handle on where things are at right now!

Perth has gone through some rapid property market changes in a very short period of time. Just 2 years ago I wrote this article on how Perth was a renter’s market. Today however, there is something interesting going on in the data of median rental costs and vacancies.

In 2014 we had a perfect storm in the rental market. The government had slowed its access to Homes West state housing, forcing many people into the private rental market. The influx of FIFO workers coming to the state also kept rental applications on every property at record highs. Landgate were slow to release the titles on most of the new estate building projects, forcing those building their own homes back into the rental market. In January of that year the average open house attendances were reaching 100 families per session! Landlords were able to name their price.

Once many of these forces eased off in 2015, with new housing estates rushing on with building after Landgate released long awaited titles and a record numbers of homes coming to market, the rental market flipped over. Rental values took a huge dive, decreasing by as much as $80 per week in the outer suburbs.

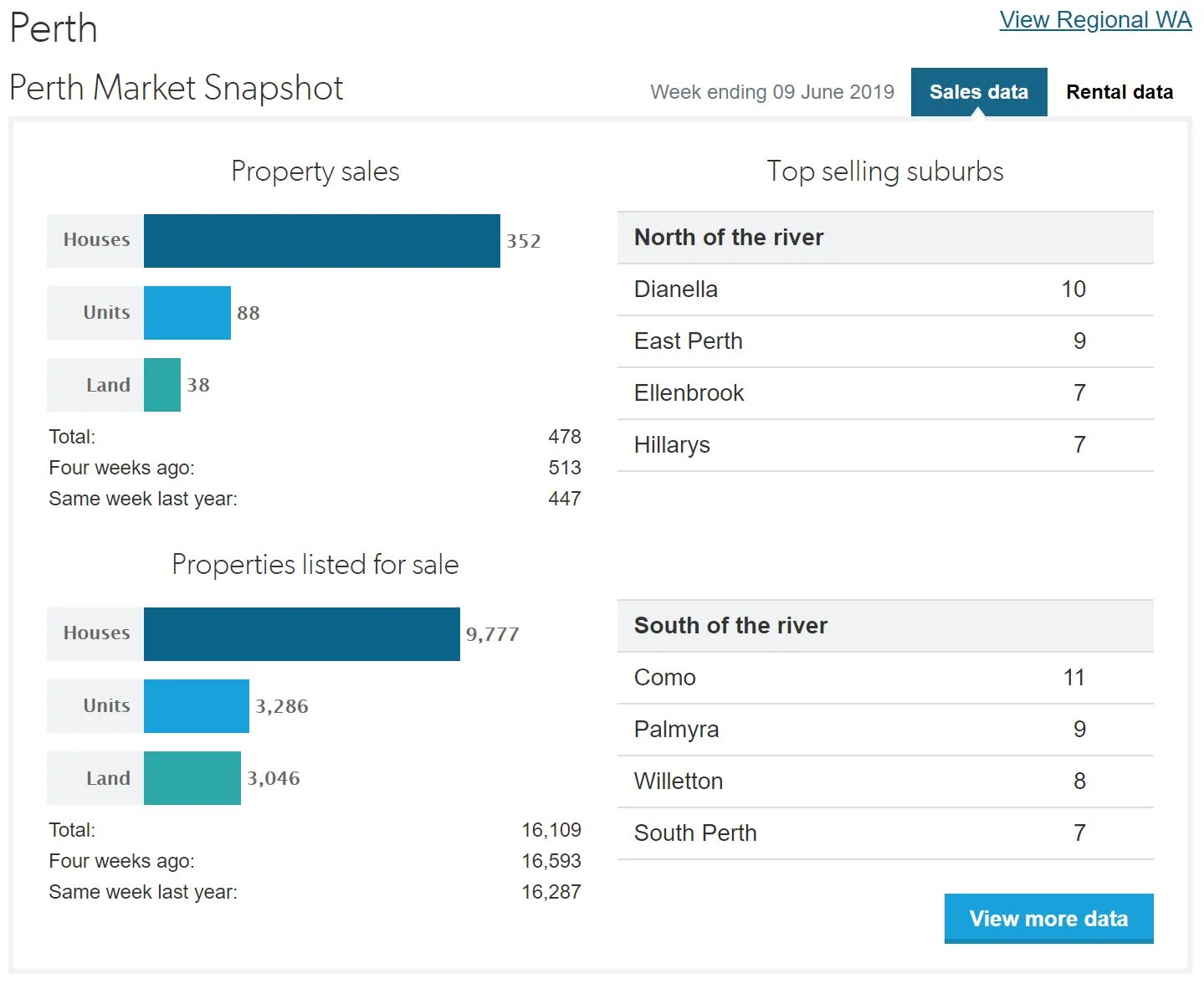

Souce: REIWA - https://reiwa.com.au/the-wa-market/perth-metro/

Fast forward to 2019 and the availability of homes to buy has stabilised and housing prices have dropped. Rental prices have stayed the same, but rental availability has recently decreased again. While this is great for renters (who are not competing for super-inflated rentals - even though we are at our lowest rate of vacancies in 2 years), we are in a stalemate with investors on one side and renters on the other.

Souce: REIWA - https://reiwa.com.au/the-wa-market/perth-metro/

If housing prices have dropped, rents should drop along with this. But with less homes on the market, competition is higher. Could we see a return to higher rents as landlords gain ground thanks to lack of supply? If financial analysts and property experts are to believed, yes.

The above graph from the REIWA website shows that there has been a slow increase in rental prices since the decrease in vacancies began. This is only an average of $10 per week across 6 months though, where there was no growth in prices for a year before that. This could be attributed to inflation and could mean that renters continue to be able to afford rentals, even with a higher level of competition.

It is all inter-connected?

As mentioned, housing sale prices are closely linked to rental values. So why are we seeing an increase in renters? One factor that many financial analysts may not be taking into consideration is the changing needs of family units as related to the current slump in housing prices, and why this is forcing many owners back out into the rental market.

All those young families who got a foot on the property ladder with their 5-year plan have found themselves coming to the end of that plan and needing to up-size or change areas. As the price of their homes has either not increased or actually dropped since their purchases, it is not the time to sell. Instead, many are renting out their homes and renting something more appropriate for themselves. While renting out their own homes will effectively cancel out the number of properties coming to market when they rent another property, most have the plan to move into their own home as soon as they can afford to sell up.

Another factor that may have been overlooked by analysts is that Perth is verging on a land drought. Many housing estates are slowing down their expansion as the glut of properties on the market and falling prices discouraging investment. Eventually this will affect the number of houses coming to market while we still have a growing population. Less houses will drive up the property prices eventually – but not before it drives rents up first!

Because of the increase in competition, real estate agents are hoping that this will drive investors back into the market and drive housing prices up again. So, who is poised to be the winners? While your guess is as good as anyone’s (Even the analysts if our breakdown is anything to go by!), here is some educated guesses that we have compiled from past data and recent market trends.

· Investors can lock in a slightly higher rent price for new lease agreements because the higher demand allows it, and almost expects it.

· Renters, on the other hand, can pick up a bargain if they get in quick and lock in the longest lease that they can at today’s rental value.

Source: REIWA https://reiwa.com.au/the-wa-market/perth-metro/

If you are considering making the move to Perth, why don’t you have a chat with us at New in Town. We can help you find the perfect property that meets your needs, help you with your move, find a school, facilities within your area, and just about anything else that will make your move as smooth as possible!

Where to look?

REIWA is the peak body for the Real Estate industry of WA. It is home to all the relevant information for renting and buying in WA and also runs one of the most comprehensive listings of rental properties in WA. It also allows you to search via the map which will help you in finding the suburbs closest to where you want to be. If you aren’t familiar with the lay of the land in Perth and get confused with all the similar sounding names (Cannington and Canning Vale, Bedford and Bedfordale!), this is a huge help!

RealEstate.com.au is the most popular website for renters, and allows you to filter your search results to very specific parameters. Need a shed, 4 bedrooms and a BBQ? This is the place to search for them!

If housing prices have dropped, rents should drop along with this. But with less homes on the market, competition is higher. Could we see a return to higher rents as landlords gain ground thanks to lack of supply? If financial analysts and property experts are to be believed, yes.